REIT INVESTING COURSE

Learn How to Become a Landlord of Multiple Properties and Collect Dividends Every 6 Months

How would you like to be the landlord of hundreds of prime properties (hotels, apartments, shopping malls, warehouses) located all around the world (US, Singapore, China, UK) and collect rental income every 3 months, for the rest of your life?

Here’s the good news: You do not need to be a multi-millionaire to make this happen. Using the power of REITs, you can start building your property portfolio today… with as little as $100!

Discover REIT Investing: The Powerful Vehicle that Gives You 10 – 14% Potential Returns a Year with Zero Effort on Your Part

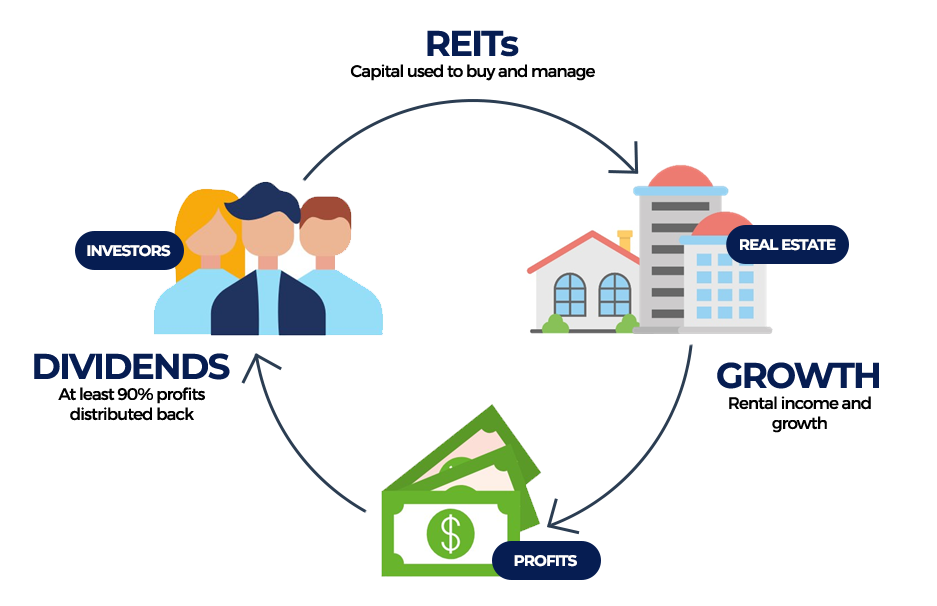

A Real Estate Investment trust (REIT) is a collective investment vehicle that allows small-time investors to pool their money together and use it to invest in income-generating properties from all around the world.

On their own, most investors can only afford to buy 1 or 2 apartments. However, by investing in REITs, you can diversify into hundreds of properties in different categories (residential, office, industrial) all around the world.

The best part? You can enjoy BOTH capital appreciation and dividend income from REITs.

In the long run, property prices increase at an average annualized growth of 5 − 6%. Not only do you enjoy this capital gain from your investments, you also receive passive income from rental dividends at average 5 − 8% yield. This potentially gives you a combined average return of 10 − 14% a year.

With REITs, the properties are professionally managed for you. You do not have to worry about wooing tenants, upkeeping the properties, chasing tenants for rent or taking huge loans from the bank.

All you have to do is purchase the REIT shares, sit back and collect your rental income cheques quarter after quarter.

Here’s Why Profit-Driven Investors Trust in REITs to Grow Their Money

![]()

Portfolio Diversification

![]()

Low Starting Capital

![]()

Guaranteed Dividends

![]()

Tax-Free in Certain Countries

Introducing: REIT Investing Course by Adam Khoo

The REIT Investing Course by Adam Khoo consists of 8 content-packed lessons over 22 tutorial videos. You’ll learn Adam Khoo’s investing secrets on how to select the highest quality REITs in the world and how to build and manage a passive income-generating portfolio to achieve financial security and freedom.

This course is perfect for:

![]()

Stock Investors & Traders

Diversify your portfolio and start a new passive income stream

![]()

Property Investing Beginners

Start your foray into real estate with as little as $100

![]()

Busy Professionals

Sit back and collect dividends quarterly with no extra effort

You’ll Love These Course Highlights

![]()

7-Step REIT Screening Strategy

Learn to evaluate any REIT and pick the best ones to invest in with 7 simple steps

![]()

Case studies from both US and Singapore

Unlock investment ideas across the globe that did not previously cross your mind

![]()

Entry & Exit Strategies

Learn exactly when to accumulate or sell your REIT shares for a winning portfolio

Course Curriculum

Lesson 1: Introduction to REITs

How do REITs work?

How REITs can turbocharge and stabilize your investment portfolio

Benefits of REITs v.s. direct property purchase

How to achieve financial freedom with REITs

Lesson 2: Understanding the Different REIT Categories

Characteristics of Retail, Industrial, Commercial, Hospitality and Healthcare REITs

How different REITs compare in terms of capital gain, yield and income stability

Lesson 3: Mastering REIT Terminology Like a Pro Landlord

Learn all about key fundamental ratios like Debt Maturity, Lease Expiry, Occupancy Rate, Gearing Ratios, Yield, Price-to-NAV Ratio and much more

Lesson 4: 7-Step Strategy for Screening the Highest Quality REITs

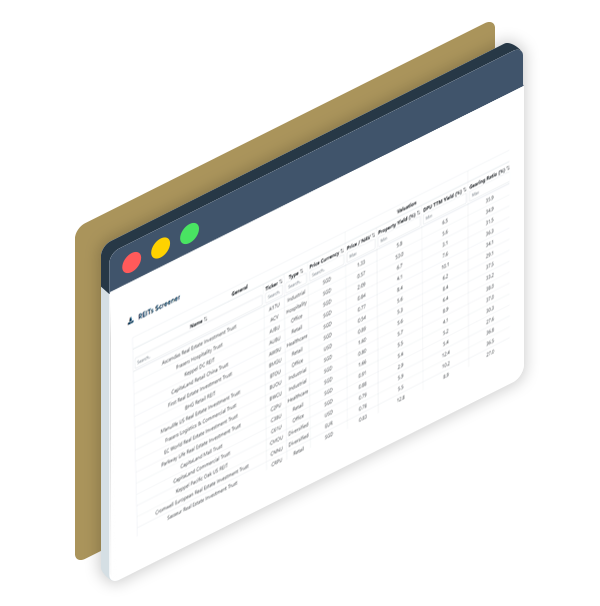

How to use automated screeners to identify the best quality REITs

Learn the 7-step strategy to evaluating the quality of a REIT

How to pick the best REITs in the world to invest in

Case studies on Singapore-listed REITs

Lesson 5: How to Analyze US-Listed REITs

Key differences when investing in US-listed REITs

Case studies on US-listed REITs

Lesson 6: Investing in REIT Exchange-Traded Funds (ETFs)

Pros and cons of investing in REIT ETFs

How to select the best REIT ETFs in the market

Lesson 7: How to Build a Winning REIT Portfolio

Keys to building a low-risk, high-return REIT portfolio

Portfolio allocation and position sizing

Entry strategies: "When do I accumulate shares in REITs?"

Exit strategies: "When do I sell my REITs?"

[BONUS] Lesson 8: How to Build Your Financial Freedom Plan

BONUS! Enroll Now and Get Immediate Access to These Time-Saving Investing Tools Worth USD 700

REIT Portfolio Tracker

Manage your REIT portfolio allocation and position sizing like a pro with this comprehensive spreadsheet.

Financial Planning Calculator

Calculate how much capital, time and investment returns you need you to build a financial freedom plan with REITs.

Exclusive REIT Screener

See the key financial figures of each REIT listing at one glance with this powerful automated scanner.

REIT Investing Course

Lifetime Access

Watch anywhere, anytime, as many times as you want!

8 Complete Lessons, 6+ Hours of Video Content

Dedicated Email Support

Get your questions answered by Adam Khoo and his team

BONUS #1

Exclusive Investing Tools (Worth USD 200)

REIT Portfolio Tracker + Financial Planning Calculator

BONUS #2

Exclusive REIT Scanner (Worth USD 500)

Check the key financial figures of each REIT at one glance

Risk Disclosure

Trading or investing whether on margin or otherwise carries a high level of risk, and may not be suitable for all persons. Leverage can work against you as well as for you. Before deciding to trade or invest you should carefully consider your investment objectives, level of experience, and ability to tolerate risk. The possibility exists that you could sustain a loss of some or all of your initial investment or even more than your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and investing, and seek advice from an independent financial advisor if you have any doubts. Past performance is not necessarily indicative of future results.