We’re entering an era where software no longer just responds but acts.

Agentic AI systems are designed to think, plan, and execute tasks with minimal human input. They combine reasoning (models), tools (apps/APIs), and memory (context) to perform multi-step actions.

The Big Idea : What’s Happening in this Age of AI Agents?

AI is not longer the simple chatbots of yesterday. They’re digital teammates that can independently manage projects, automate operations, and make decisions using data and context.

Over the past year, there’s been a wave of headlines about major companies laying off employees. Not because they’re running out of cash or facing a crisis, but because they’re restructuring around AI. Some firms are posting record profits and still cutting staff to make room for machine-powered workflows.

A clear example: Amazon, which announced roughly 14,000 corporate job cuts while simultaneously increasing its AI investment. Across sectors, leaders are reallocating resources from people to platforms. AI isn’t a side project anymore; it’s quickly becoming the main event.

The Current Landscape of AI Agents

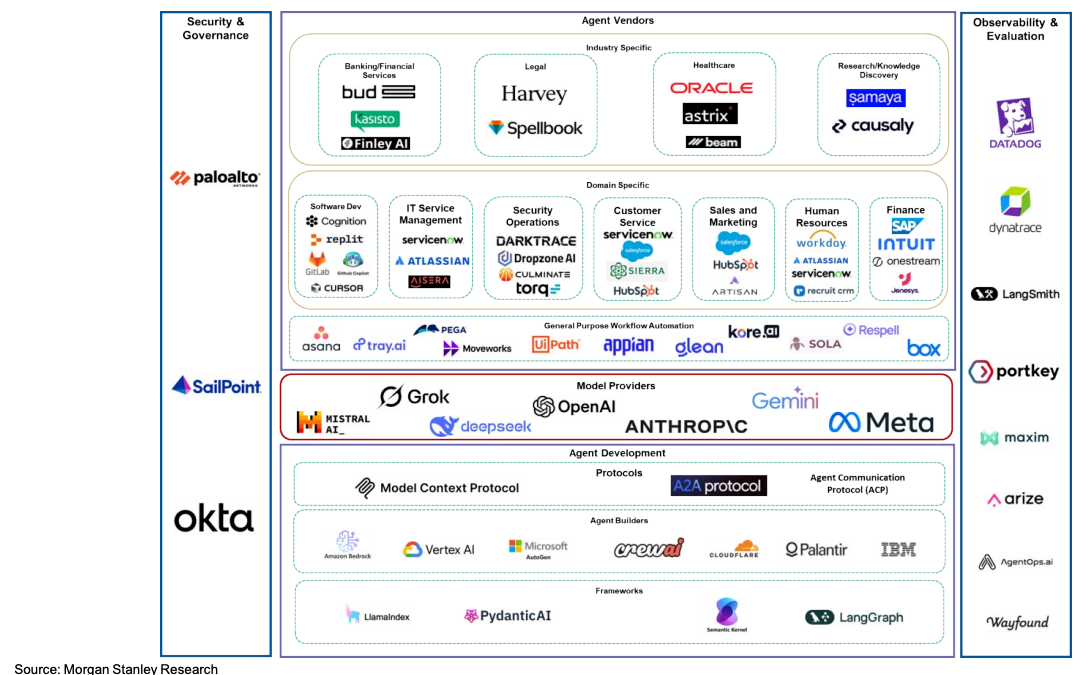

If you’ve ever wondered who’s actually building this new “AI agent world” everyone keeps talking about — this chart maps it out. It’s not just a list of tech companies; it’s a blueprint for how the entire Agentic AI ecosystem fits together.

Think of it like a digital economy being built from the ground up, layer by layer from the brains of the system (AI models) to the apps we’ll use every day (AI agents in banking, marketing, or customer service).

How It All Connects

Every layer in this chart builds on the one below it, forming a complete ecosystem of intelligence, execution, and control.

- Model providers like OpenAI, Anthropic, and Meta create the intelligence core, the reasoning engines that power autonomous behavior.

- Developers and frameworks — such as LangChain, Palantir, and Microsoft take that intelligence and turn it into functioning agents that can act, learn, and adapt.

- Vendors like ServiceNow, Oracle, and HubSpot then deploy these agents across business functions, from customer service to cybersecurity.

- Governance and observability players — Okta, Cloudflare, Datadog — make sure these agents stay secure, accountable, and reliable as they scale.

This architecture is evolving much like the cloud ecosystem once did:

infrastructure at the base (AWS, Azure), software platforms in the middle (Salesforce, ServiceNow), and monitoring and security at the top.

What the chart reveals is that Agentic AI isn’t a single breakthrough, instead it’s a coordinated system. From the companies training the “brains,” to those deploying the “workers,” to those guarding the digital perimeter, each layer plays a role in shaping this next era of intelligent automation.

Together, they’re building a future where software acts, decides, and drives business outcomes on its own.

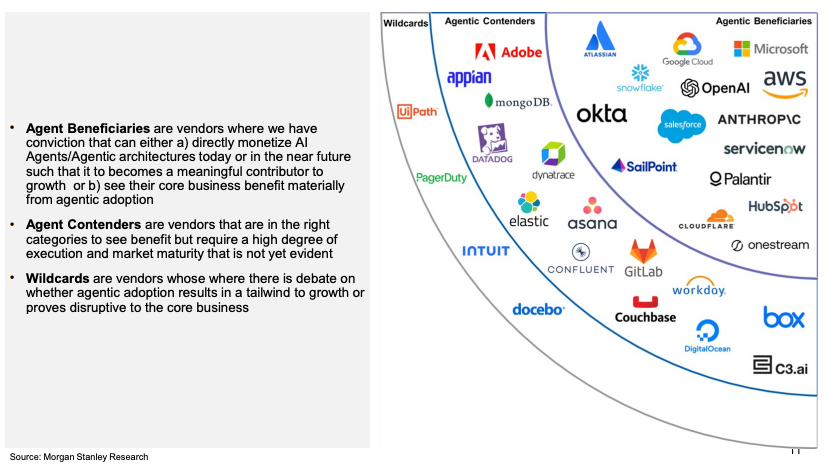

Which Businesses Could Capture the AI Agentic Opportunity

The three main groups of companies based on their readiness and ability to benefit from Agentic AI are categorized as Agentic Beneficiaries, Agentic Contenders, and Wildcards.

AI Agentic Beneficiaries

Agentic beneficiaries are companies that are already making money from AI agents or positioned to do so. They either build the agents or own the platforms where agents operate.

These companies have :

- Deep integration into enterprise workflows.

- Access to critical company data and users.

- Strong cloud, model, or SaaS infrastructure.

Examples:

- Microsoft (MSFT) – integrating Copilots into all its software and cloud stack.

- Google (GOOGL) and Amazon (AMZN) – running the compute power and APIs that every AI agent depends on.

- OpenAI, Anthropic, ServiceNow (NOW), Snowflake (SNOW), Palantir (PLTR), HubSpot (HUBS) – leading the charge in AI-native applications.

- Okta (OKTA), SailPoint (SAIL), Cloudflare (NET) – securing identity, governance, and data pipelines for safe agent operation.

Agentic Contenders

These companies are in the right space, but might require market maturity, execution and adoption to prove their potential.

These companies have :

- AI capabilities but not yet monetizing them at scale

- Tools are essential but dependent on broader enterprise readiness

Examples:

- Adobe (ADBE) – embedding generative AI in creative workflows.

- Atlassian (TEAM) – automating software and project management tasks.

- Elastic (ESTC), Asana (ASAN), PagerDuty (PD) – adding intelligent automation but awaiting mass uptake.

- Datadog (DDOG) – enabling observability and performance tracking for AI-driven systems.

Final Thought : Putting the AI Stack in Context in the Age of AI Agents

For investors, the real opportunity isn’t in chasing the flashiest new agent. It’s in understanding where the long-term value builds up in the ecosystem.

At the foundation are the infrastructure providers, the ones running the “power grid” for AI. Every time an agent performs a task, it consumes compute, storage, and connectivity. This layer earns from the constant demand. These same players are also expanding into the connective functions that enterprises rely on: retrieval, security, governance, and policy enforcement.

Above them sit the model developers, advancing reasoning and intelligence. They form the “brains” of the system and set the pace for how capable agents become.

Then come the enterprise integration layers. Security, governance, and data infrastructure, that make agents safe, auditable, and reliable inside real businesses. They may not grab headlines, but they capture budget as experiments turn into production systems.

The lasting value lies not in individual AI products but in the foundation. Those building the grid, the intelligence, and the trust layers that make the entire agent economy run.

submit your comment