Hi everyone, it’s Adam Khoo here. In this article, I’ll share with you how I invest in the stock market and why it is in my opinion the best way to invest in stocks.

In this article:

You will learn about my trademark Value Momentum Investing™ strategy and how I use it to beat the S&P 500’s returns every year.

Before we dive right in, you need to first understand the basics of this strategy and what makes it the best way to invest in the stock market.

Let’s go through the different styles of investing.

What Is Value Investing?

One of the most popular ways of investing is value investing, which is the method used by legendary investor Warren Buffett.

This method of investing aims to buy shares of great companies that are trading at massive discounts to their intrinsic value. Simply put, it means to invest in stocks that are heavily under-priced, compared to their true worth.

To determine if it is a smart investment, investors need to first find out if the underlying business is a good one. This is done by analysing their financial reports, including the income statement, balance sheet and cash flow statement. We call this fundamental analysis.

Now, what happens when value investors find a fundamentally good company? They don’t invest in it right away. Instead, they only invest when the stock is trading below its intrinsic or true value. They look at a specific set of criteria that tells them this company is a worthy investment.

Disadvantage of Value Investing: Cheap Can Get Cheaper

Now I love value investing and all but there are some limitations to it.

First, just because we get in when the shares of a company are trading at a discount does not mean that it won’t get cheaper.

Remember that in the short term the market is irrational and tends to overreact to both good and bad news. We know that the share price of good businesses will always go up in the long run, but in the short term, cheap can get cheaper.

Let me show you an example from the 2020 stock market crash.

Facebook (FB) stock chart example

Source: thinkorswim

As you can see from the chart above, the intrinsic value of Facebook (FB) was about $220 and the initial crash brought it down to $179, which was a nearly 20% discount. Many value investors would have entered here.

However, price continued falling all the way down to about $139, giving us a 37% discount to valuation.

People who bought at the higher price would lament, “Why did I use up all my cash so fast? I should have waited till the price bottomed.”

The truth is, nobody can predict the stock market prices. But as a value momentum investor, I was able to enter nearer to the bottom at $159, when signs of reversal emerged on the charts.

So you see, when you do pure value investing and don’t look at technicals, you may buy during a downtrend and watch your investments drop in value until the trend eventually reverses.

That’s okay, you’re still getting a good deal as long as you buy great companies below intrinsic value.

But if you want to buy at an even better price and maximize your returns like I did, then Value Momentum Investing™ is the best way in my opinion.

Best Way to Invest in Stocks: Value Momentum Investing™

So how do we maximize our returns from value investing? The answer is to add “momentum” into the picture, which I call Value Momentum Investing™ (VMI™).

In Value Momentum Investing™, the key principles of value investing remain. We only invest in great businesses that are undervalued. However, to further increase our returns from the stock market, we only invest when the stock price is on a clear uptrend or reversing into one.

In other words, Value Momentum Investing™ combines fundamental and technical analysis to help us better time our entries so we can maximize our investment returns. This makes it the best way to invest in stocks.

Value Investing vs Value Momentum Investing™

Let’s look at how these two investing methods compare, using a stock chart example.

Value Investing vs Value Momentum Investing™

Source: thinkorswim

See the above stock chart of Amazon (AMZN). At the time of this snapshot, its intrinsic value was about $3,000. An entry at $1,950 would be typical based on pure value investing.

However, by adding momentum into the equation, my students and I waited to enter at a support level, when price was $1,800.

In comparison, based on the stock’s current price at the time of this snapshot, the Value Momentum Investing™ approach made a return of 39% while the pure value investing approach made a 28% return ─ a difference of 11%!

How Does Adam Khoo’s Value Momentum Investing™ Strategy Work?

Here are the three keys to my trademark Value Momentum Investing™ strategy.

Key 1: Identify Very Good Businesses

There are about 7,000 stocks listed on the US stock exchange and many more globally. Do we have to invest in all of them? No, we only want to pick the best ones.

Here are some criteria I look at to determine the best companies.

Consistently Increasing Sales, Earnings and Cash Flow from Operations

First, the company we are investing in must have a good track record of consistently increasing sales, earnings and cash flow from operations. This tells us that the company is a profitable and growing one.

Strong Competitive Advantage

Next, we want the business to have a strong competitive advantage. Warren Buffett calls this a wide economic moat that protects the business from competition.

This criterion ensures that we are only investing in companies that can continue dominating their industry for years to come.

Some good examples of such companies would be Google, Amazon, Facebook and Costco.

Now, what gives a company its competitive advantage? There are four main factors:

- Brand monopoly

- High barriers to entry

- High switching cost

- Network effect

Brand Monopoly

What’s the first thing that comes to your mind when you think of fast food? I’m guessing McDonald’s. What about social media? I’m guessing Facebook or Instagram.

Brand monopoly is one of the factors that gives a company its strong competitive advantage.

For example, McDonald’s has successfully established itself as one of the most globally-recognized fast food brands today.

High Barriers to Entry

Certain industries are highly regulated, which gives companies within it the competitive advantage of high barriers to entry.

For example, Boeing enjoys its wide economic moat from the high barriers to entry in the airplane manufacturing industry.

Can anyone just start an airplane manufacturing company without the intensive capital resources required? I don’t think so.

High Switching Cost

A very good example of this would be Adobe. Adobe’s products are used by designers and marketers who have spent years in college or design school mastering the use of such software.

Thus, in the workforce, companies are inclined to use Adobe’s software since it’s what most of their designers and marketers were trained to use.

A decision to switch to another competitor’s software would be very expensive as it involves retraining. This high switching cost is what allows Adobe to continue dominating the design industry for years.

Network Effect

We can easily understand this by looking at social media these days.

Why are people on Facebook and Instagram instead of MySpace? Well, it’s because everyone else is using Facebook and Instagram and no one uses MySpace!

Network effect is the phenomenon whereby people use a product or service purely because everyone else is using it. And the more people that use it, the stronger the network effect becomes.

In order to connect with your friends, you must use Facebook, Instagram and other prominent social media platforms. This also gives the company a strong competitive advantage.

Companies with a strong competitive advantage can continue to thrive in their respective sectors and industries, making them good businesses to invest in.

Conservative Balance Sheet

Even with the best track record of financial performance and strongest competitive advantage, a business that cannot survive tough times is not a good business.

Throughout a company’s lifespan there are bound to be crises, whether it’s lawsuits, financial crises or even the COVID-19 health crisis. Whether a company can tide through tough times and come out stronger depends on how conservative it is.

A company that is highly leveraged with high debt and low cash will not be able to survive challenges and will eventually go bust regardless of how profitable or strong the company once was.

Hence, the last criterion in identifying a good business is a conservative balance sheet.

Key 2: Invest Only When the Stock Price Is Undervalued and at Support Levels or Dips on Uptrends

This is where we combine fundamental and technical analysis to help maximise our investment returns.

Firstly, we only invest when stocks are undervalued. This could be caused by irrational fear in the markets as a result of bad news or a potential crisis. It is during such times when stocks are often trading at undervalued prices which is the best time to get in.

Like what Warren Buffett says, “Be greedy when others are fearful.”

Using my Intrinsic Value Calculator, which all my course students get access to in my Whale Investor™ stock investment course, we are able to determine what a stock is truly worth to help us know when to get in.

For example, during the China food scandal a few years back, YUM’s share price plunged below $45, significantly below its intrinsic value of $65. This presented a great buying opportunity.

But when exactly should we enter? To answer this, we need to look at the “momentum” in price movements.

By buying only when stock prices are at support levels or dips on uptrends, we can ride the trends to give us a higher probability of entering at optimal points. This allows us to maximize our returns.

Remember that stock prices are irrational in the short term. Just because you entered at optimal levels does not mean stock prices will definitely rise from there. We can time our entry based on probability, but it is impossible to predict short-term price movements.

That is why we also never enter our investment positions at one go. Instead, we dollar cost average by splitting our position into tranches, entering bit by bit.

This way, if stock prices continue falling even when we buy at support levels or dips on uptrends, we simply buy more when it reaches the next support level.

Key 3: Exit Investment When Fundamentals Deteriorate, Stock Is Overvalued and/or on Downtrend

Last but not least, if any of the criteria above no longer applies to our investment, it’s time to make our exit.

As soon as the company no longer has a good track record of earnings, has a weakening economic moat or gets overvalued and starts going into a long-term downtrend, then it is no longer a good investment.

On a Last Note

This sums up the principles of my Value Momentum Investing™ strategy ─ what I think is the best way to invest in the stock market.

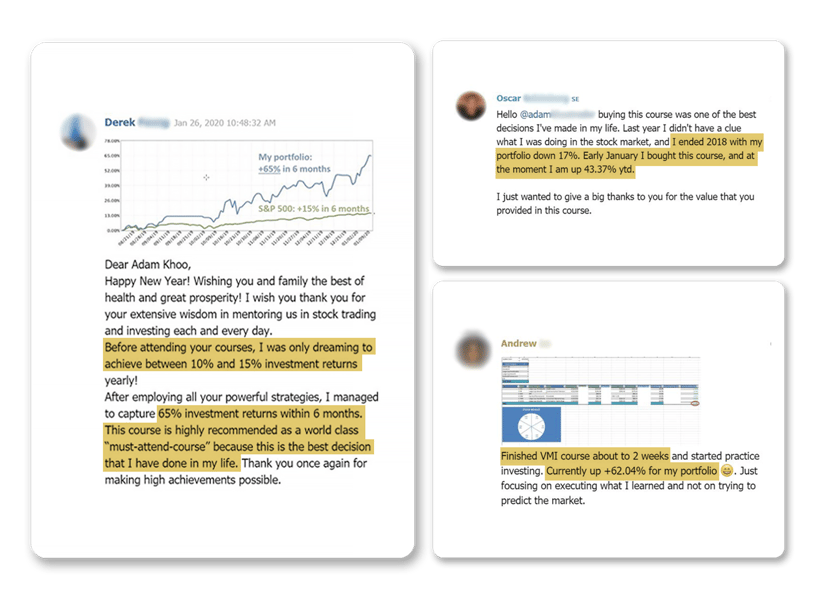

Using this strategy, we get the best of value investing and momentum investing, allowing us to achieve index-beating returns from the stock market. While most investors would be happy with a 10−12% annual return, many of my students are achieving results of 25−50% annual returns.

Here are some results from my students:

If you want to learn my 7-step strategy for picking great businesses and know the best entry time to maximize your returns, do check out my Whale Investor™ Value Momentum Investing™ course.

.png)

.png)

.jpg)

submit your comment