Stocks got whacked on Friday.

The S&P 500 went down about 3%, the NASDAQ went down almost 4%.

So was that expected?

Absolutely! I told you guys in my last video that stocks don't go up in a straight line. We will have a pullback after an overextension.

So let's revisit the charts again and see where we are.

Table Of Contents

My Short, Medium, and Long Term Outlooks

Analyzing What Jerome Powell Said On Friday

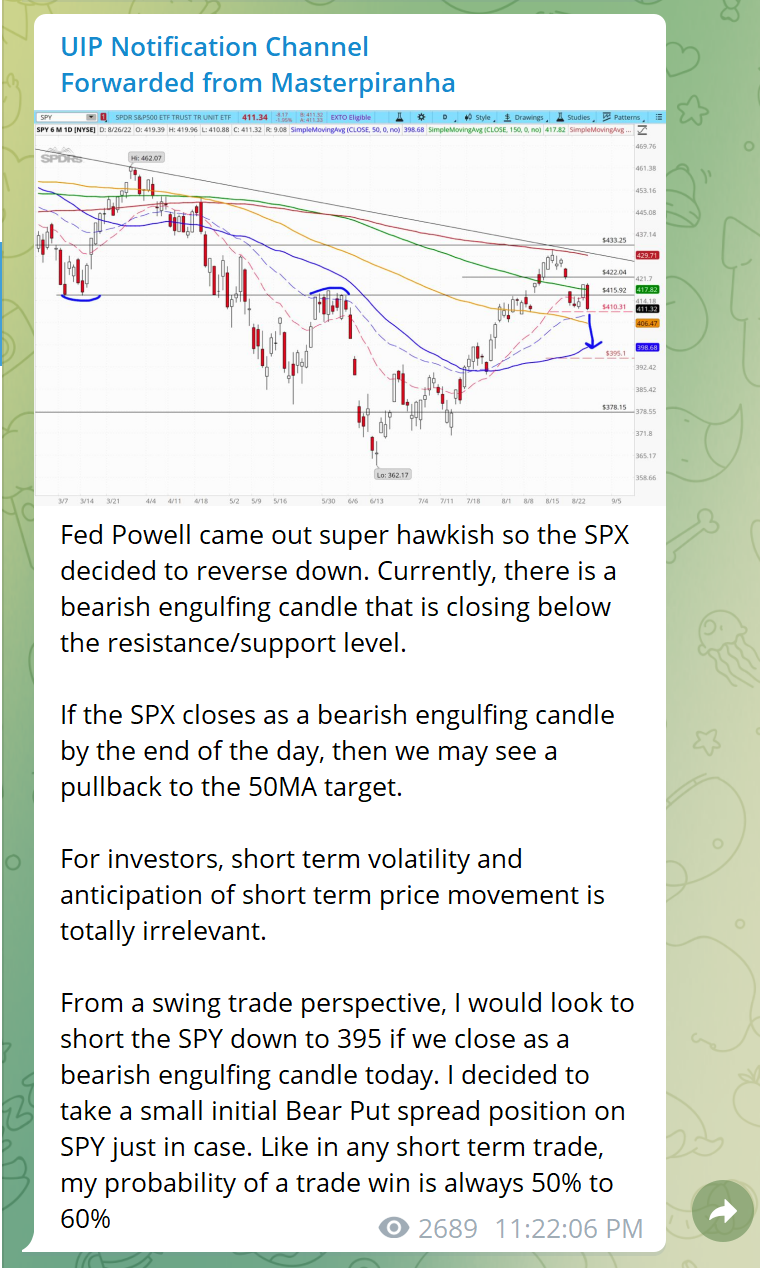

In my previous videos, I said "Hey this is a strong level of resistance that prices were coming up towards, at the same time it is also coinciding with the 200 moving average resistance,"

So sure enough, we hit that resistance (Red Line), pulled back from it, and we see another strong level of support and resistance over at 4158. We pulled back down, and for a brief moment, it looked like we found support at that level and we're bouncing back up.

But then on Friday, there was a speech by the FED chairman Jerome Powell, and that was the trigger that caused the market to drop significantly that day.

So those of you who understand technical analysis what do you see?

We see what is known as a BEARISH ENGULFING pattern, which is a bearish reversal pattern if you understand candlesticks. This happened at a significant level of resistance and support, so based on price action, it's safe to assume there's a high chance the market is going to go back down for the short term — at least towards that 50 moving average (Blue Line) and maybe even below that.

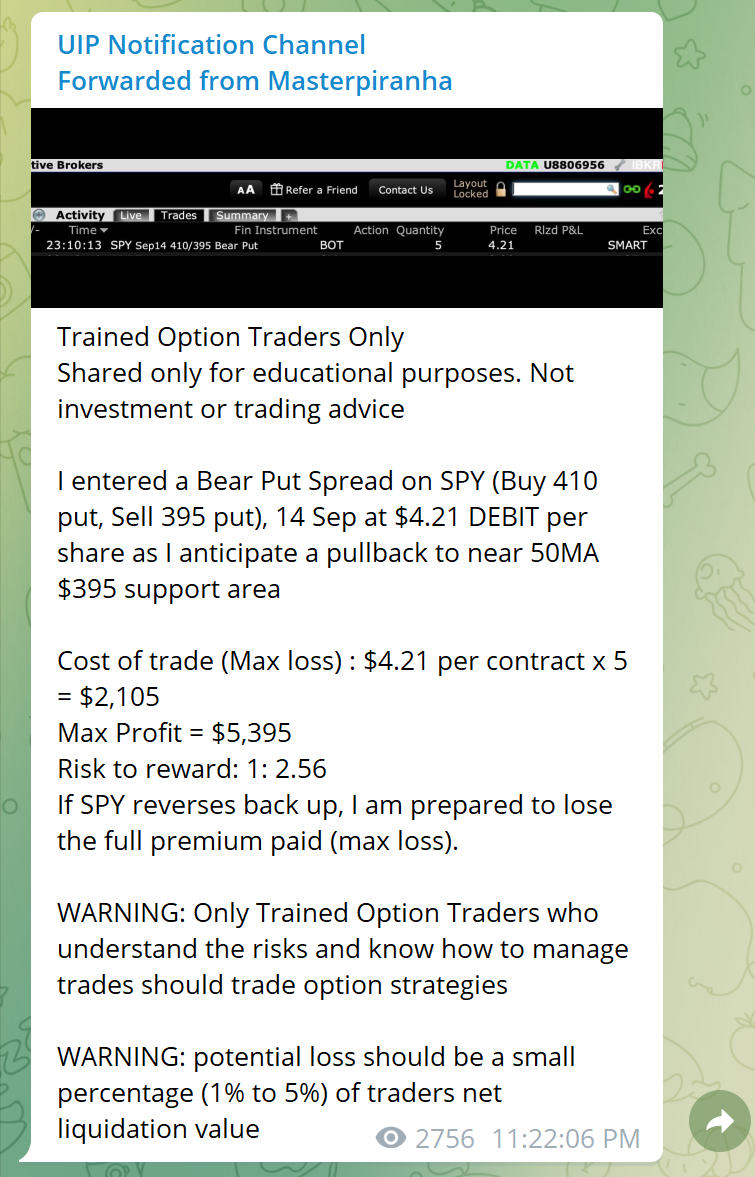

So because of that, I went to short the market — I added to short positions by buying BEAR PUT SPREADS on the SPY ETF.

I bought puts at the 410 strike price and sold some puts at the 395 strike price, creating a Bear Put Spread.

Those of you on my 'UIP' notification channel and the Options Iron Striker chat group, this was the alert I gave the moment I entered that trade on the 26th of August, which was Friday, at the beginning of Powell's speech actually.

My Short, Medium, and Long Term Outlooks

Now some people who watch my videos may be a bit confused because I said I'm bullish.

What you got to understand is that you have to separate short-term, medium-term, and long-term.

Short-term I'm bearish based on the price action and also based on the fact that I told you after wave up, you gotta have a wave down. We're also going through the seasonally bearish months of September & October where the market tends to be more bearish before a strong rally in November-December.

That's why I'm shorting the S&P using options. How low it will go, I don't know. No one can predict exactly how it's going to go, but as I said in my previous videos, I believe that this particular bear market has already bottomed.

The 15th or the 16th of June was likely the bottom of this bear market. But it doesn't mean that the bear market is over. We are still in a bear market and we don't have a bull market yet, but what I just said was likely the bear market has bottomed based on what I'm reading in the macro fundamentals and the fundamentals of businesses.

Medium-term in the next 6 to 12 months, I'm bullish, because the economy is doing very well, the labor market is very strong, and corporate earnings have been better than expected. In fact, corporate profit margins are the highest they've been since 1950.

Companies are doing very well, the economy is doing really well, and the only thing that's pulling it down in the short term is this fear of high inflation and the FED tightening monetary policy. I think we're going to end up at all-time highs by end of the year or next year.

Long-term I'm always bullish because in the long term 5 to 10 years, the market always goes up.

The fact that the market is pulling back down now, is that good or bad news?

I always believe that in life there's no such thing as something that's good or bad — it's your reaction to it, how you respond, how you react to it. So it's not the event that determines your outcome; it's how you respond to the event.

So to me, everything is good news!

The market goes up = good news

The market goes down = good news.

I go with the flow.

When the market goes down, it's good for a trader because you can short the market and make money as it goes down.

As an investor, if you're buying great companies or you're buying ETFs, when the market goes down, it's great news as well because it gives you a chance to add more shares before it eventually goes up in the long run.

I tell my students who are investing, "Those of you who felt that the bus went up too fast, the bus is now turning back to pick up more passengers before it goes back up again."

In the meantime, use the chance to add shares of great companies or off Index ETF.

In my trading portfolio, I'm shorting the market, but in my investment portfolio, I'm buying stocks.

You've gotta learn how to combine both your trading & investment strategies to succeed in the markets.

A lot of people blame FED chair Powell you know because "He opened his mouth, because of what he said, that's why the market went down!"

I look at it pretty differently; I don't believe that events caused the market to move. It is how people respond to the event that moves the market, and to me, whether or not Powell said something or someone else said something, the market was going down anyway.

It's because of the technical setup!

We hit a level of resistance, the market was overextended, and we're going towards the bearish September-October period.

The market needed an excuse to go down, so whatever happens, the market always finds the excuse and goes down.

Market makers tend to manipulate the markets to shake out the 'weak hands' so that the weak hands get purged out of the market, and then the market makers and the institutions will drive up stock prices again.

So always remember that the market always finds an excuse to do what it already wants to do.

Get The Latest stock market analysis & tips every week!

Subscribe to our weekly Newsletter FOR FREE!

*Your email address will not be forwarded to any third party. We respect your privacy.

Analyzing What Jerome Powell Said On Friday

Let's focus on what FED Chair Powell said and why did what he said have a reaction to the markets, and if anything fundamentally changed before Friday.

Nothing really changed before Friday. If anything, financial conditions are actually getting a bit looser.

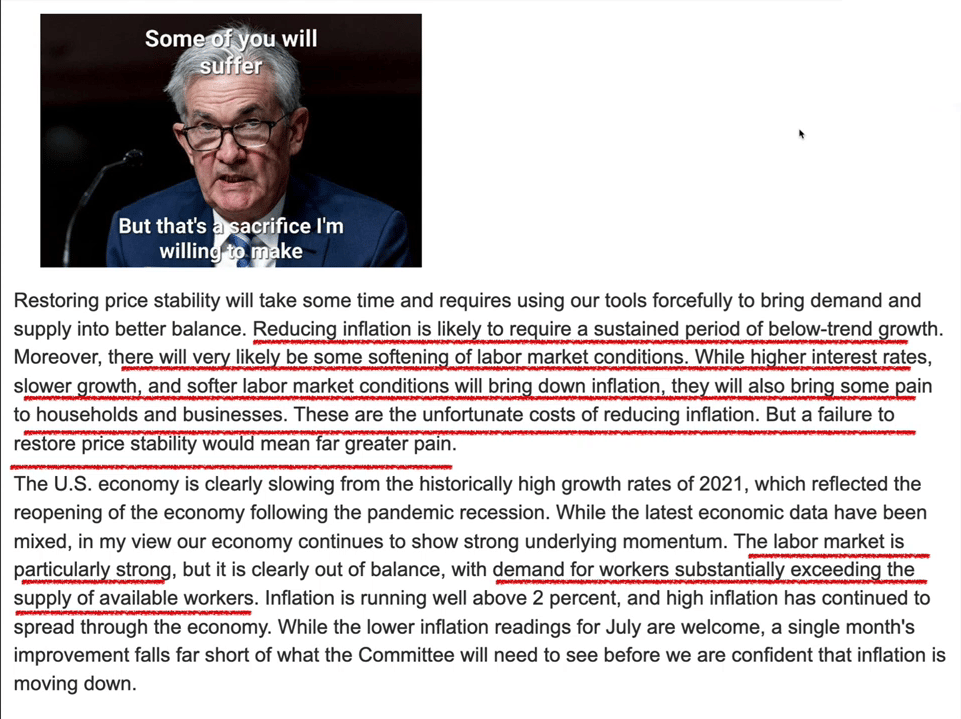

The main gist of what he said was that they are going to do whatever it takes to bring inflation down back to 2% and they're not gonna back off anytime soon.

They're gonna continue to raise interest rates and keep them high for some time and while some of us will suffer, they don't care. We need to have some short-term pain for long-term pleasure.

Powell said that reducing inflation is likely to require a sustained period of below-trend growth.

What he's saying is that in a short term, he's going to sacrifice growth in order to bring down inflation. They're going to cause the economy and corporate earnings to slow down.

Of course, people get freaked out, and they sell off the growth stocks and they all collapse.

As an investor, am I concerned?

Of course not, because I know that these companies will grow over the long run!

So if the FED wants to artificially push growth down in the short term, it doesn't matter. It gives us a chance to buy more shares before it resumes its growth trajectory again.

Then he says moreover there'll be very likely to be some softening of labor market conditions. So what he's saying is that the labor market is now too strong, and the job market is too good. In fact, he said that the labor market is very strong and it's out of balance with the demand for workers substantially exceeding the supply of available workers. He's saying unemployment is too low, he doesn't mind increasing unemployment to get people to go back to work!

"These are the unfortunate costs of reducing inflation. But a failure to restore price stability will mean far greater pain."

He reminds me of Clubber Lang from Rocky III, and when they asked Clubber Lang what's his prediction, he said "PAIN", and people freaked out!

That's why the market tended to freak out and that's what caused that reactionary drop on Friday.

So FED Chair Powell is like the father, and the stock market is like his daughter.

Now he loves his daughter and he wants his daughter to succeed obviously, but he feels that his daughter is having too much fun right now; she's too high, and she's partying too much. He's afraid she may overdose or she may flunk her exams and drop out of college. So he threatened her on Friday "You know what, I'm gonna take away your phone, cut your allowance," and so the daughter was obviously not happy, in a bad mood, and that's why the stock market dropped!

Interesting Thing About The Bond Market

The interesting thing is if you watch the bond market, it's basically saying "I'm calling your bluff Mr. Powell. You're not gonna raise rates even more, you're not gonna do more than what you've already said. You're just talking tough, you're not gonna follow through."

So why do I say that? Let me show you something interesting.

After Powell's speech, you would expect that the 10-year treasury yield would go up a lot, and the 2-year yield will go up a lot in expectation of higher FED funds rates.

But they didn't really go up that much.

If you take a look at the US government's 10-year yield, what happened on Friday; it did not go up. It stayed where it was! If you look at the 2-year treasury yield, yes it went up but only slightly to 3.4 %.

What does this really mean?

This means that the market expects that interest rates will be at 3.4% in 2 years. Currently, the FED funds rate is 2.25% to 2.5%. Before the Friday speech, the market expected the FED to raise interest rates by another 1% to 1.25%, which means raising interest rates to 3.5% — this was before the speech.

Now after his speech, you would expect that the market would price a higher rise in long-term interest rates because he said "I'm going to raise interest rates even more," but it didn't.

The 10-year yield remained the same and the 2-year yield is now only at 3.4% which is lower than 3.5%. Basically, if you look at the bond market, it's calling his bluff.

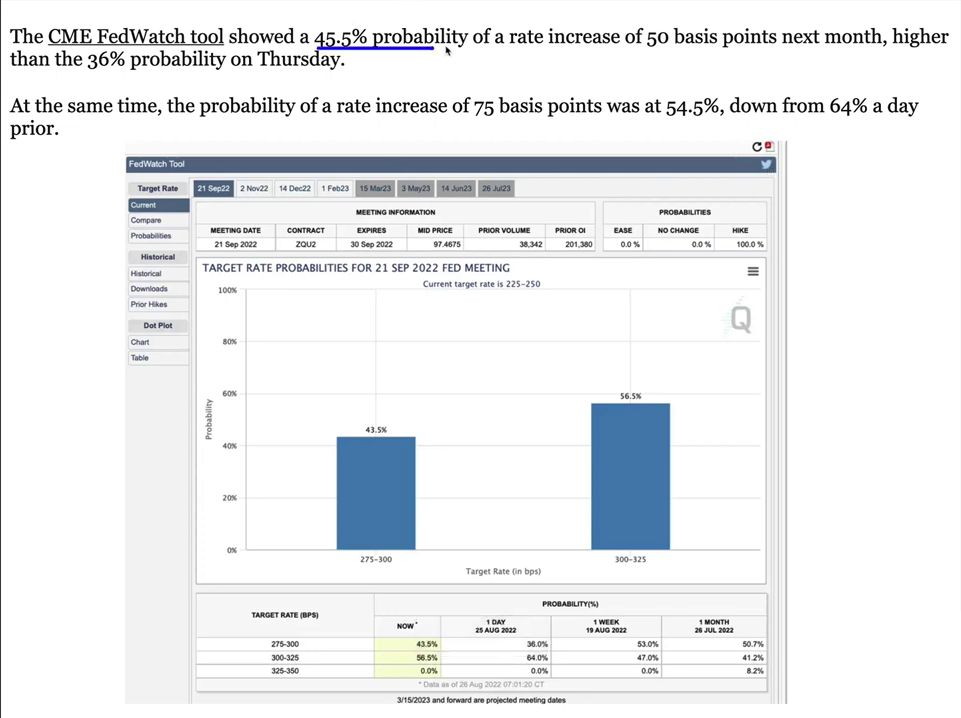

Here is more proof that the bond market realizes that Powell was just talking tough to threaten the 'daughter' but he was not really gonna raise rates more than what's expected, and this is the FEDwatch tool.

You can see that before his speech there was a 45% probability of a 50 basis points interest rate increase next month in September which is 0.5%, higher than the 36% probability on Thursday. At the same time, the probability of a 75 basis point hike was at 54%,

down from 64% a day prior.

So what does this mean?

Before his speech, the market was kind of like guessing if he's gonna raise interest rates by 75 basis points or 50 basis points. Before the speech, there was a higher probability that they were going for the 64% of a 75 basis points hike in September. After the speech, it didn't go up. It went down to 56%, and the market, from believing that he's going to raise

interest rates by 50 basis points, from 36% it now went up to 43%.

So this is something really weird. In other words, after the speech, the bond market and the market in general are expecting that he's going to be less aggressive than more aggressive.

So why is there a difference between what he said to what the market believes?

The market realizes that inflation has actually peaked and the drivers of inflation have all but dissipated, so they realized that the only reason he talked tough was to get the market to come down temporarily because it was going up too fast.

He was afraid that if the market goes up too fast, it will reignite inflation. So he did that to purposely pull the market down in the short term, but nothing has really changed in the actual FED policy.

The facts remain the same like I keep saying, before Friday and after Friday, nothing changed; the facts are the same.

Inflation Is Decelerating!

The reason the market believes that the FED doesn't have to increase tightening more than they've already said is that inflation is actually coming in better than expected; it's decelerating!

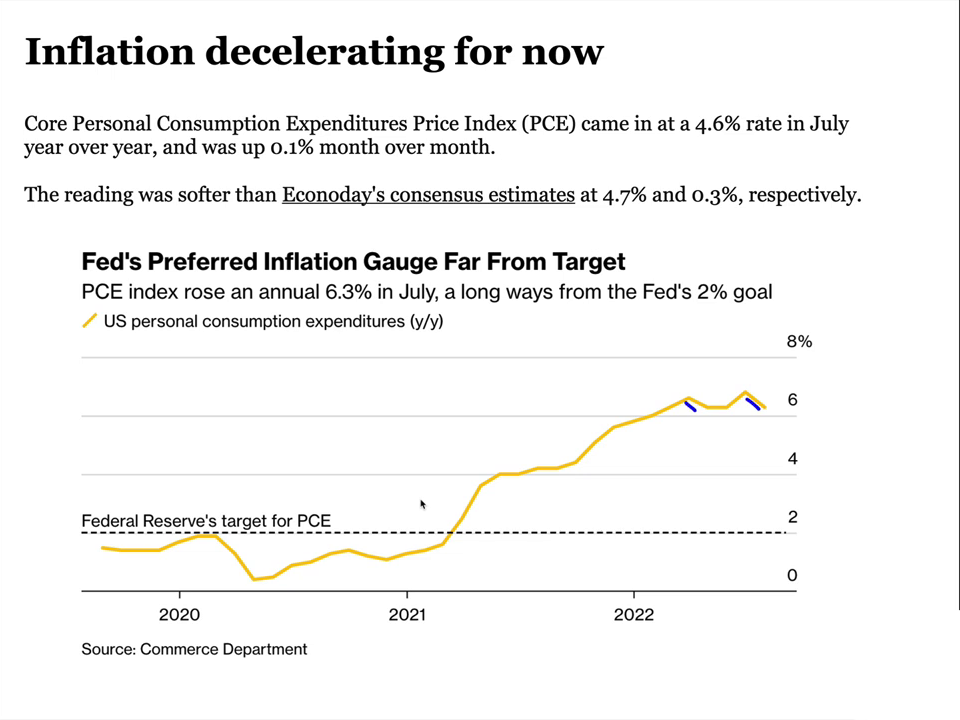

On Friday if you take a look at the core PCE — which is the main indicator that the FED looks at — it came in at a 4.6% rate, which is the inflation rate in July which is lower than the 4.7% expected.

So current inflation data is continuing to moderate, but the FED says they want to make sure there's a clear trend and not just a short-term moderation.

If you take a look at the 5-year break-even inflation rate, it continues to be on this downtrend pattern, although you can see it picked up a bit slightly. I think that is what concerned the FED and so they want to talk tough to make sure that it remains down and it doesn't go back up again.

The good news is this if you take a look at what has been driving inflation in the last 2 years, it has dissipated.

#1: OIL PRICES

Oil prices have been driving up inflation, but oil prices have been going down! You can see crude oil prices in that downtrend pattern and still remains below the 200 moving average.

#2: US HOUSING

Housing has been a second driver of inflation. Home prices go up because demand exceeds supply, but now it has completely reversed. Housing demand has been declining, new home sales have dropped to about -35% which is the biggest drop in home prices since the Great Financial Crisis and that's what's freaking some people out. It's a totally different situation.

At that time, a lot of the homeowners were on adjustable rate mortgages, many of them had no income or no jobs and couldn't

pay their mortgages. In today's environment, homeowners are mostly on fixed-rate mortgages, they have got jobs, and they've got income to pay their mortgages. Back in 2008, banks were highly leveraged with all these toxic mortgage assets, but today banks have much lower leverage.

In other words, there's no systemic risk in the financial system as there was in 2008, so even if home prices continue to fall yes there could be a recession but there will not be kind of like a major financial crisis of 2008-2009.

#3: SUPPLY CHAIN DISRUPTIONS

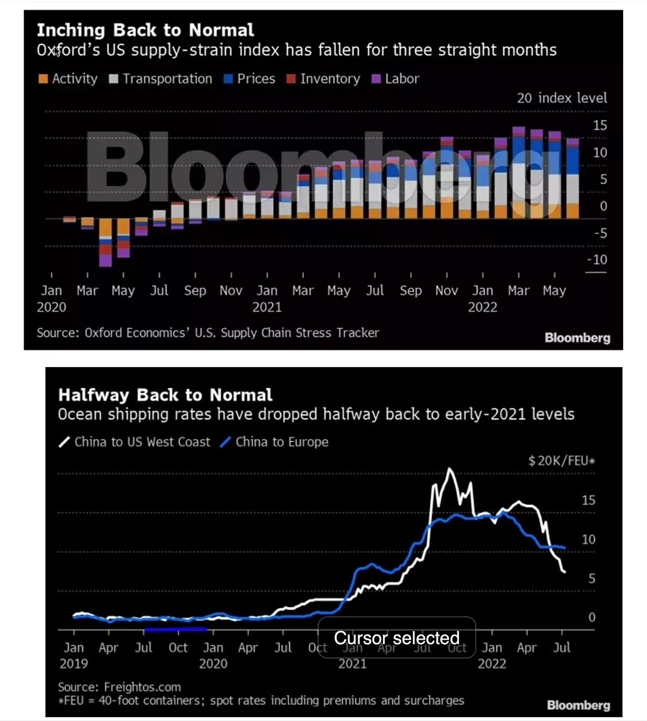

The 3rd thing that was driving inflation was of course supply chain disruptions from the Ukraine war and from China's Covid zero policy. All that supply chain disruptions cause delays in shipping and in logistics. This causes prices to go up. The good news is that supply chains have been easing significantly.

You can see that Oxford's US supply-strain index has been falling for 3 straight months up to June and in fact, July-August it

has fallen as well. The strains on supply chains are easing.

Look at ocean shipping rates — shipping rates are one of the main indicators of supply chain disruptions, and when there were disruptions, freight rates went up. But now, shipping rates have fallen dramatically and are in fact in a bear market.

At the same time, China, which is involved in a lot of supply chain and logistics globally, they'll be having its CCP party congress and there's a high chance that after the congress, it will lift its Zero-Covid policy.

So that's good news! The moment they lift the Covid-Zero policy, then supply chain problems would basically all go away, and inflation will continue to go down.

The Bottom Line:

The FED loves the stock market and loves the economy. They want the economy and the stock market to succeed, but in the short-term, it's partying too much, having too much fun, and that could screw up their inflation agenda. That's why Powell needs to talk tough to bring the market down in the short term.

Short term I'm bearish, I've taken short positions in the S&P and some stocks but of course, in the medium-term in 6 to 12 months I believe that stocks will be a lot higher because the underlying economy is strong, and yes, although the FED wants to raise unemployment by a bit — they want to slow down housing — it may cause a mild recession, but it doesn't matter.

We will not get the kind of crash in 2008 or 2001 because the economy is a lot stronger, corporate balance sheets are stronger, companies have record-high profit margins, and again if you hold on to great companies with pricing power, with solid balance sheets, with huge amounts of free cash flow, they will do really really well.

As always, avoid companies that are speculative, that are losing money, and are only driven up by hype and cheap money because those are the ones that collapse and they will never come back.

Stick to good companies or simply stick to the index ETFs, average in when you see a pullback and you'll do very very well.

Get The Latest stock market analysis & tips every week!

Subscribe to our weekly Newsletter FOR FREE!

*Your email address will not be forwarded to any third party. We respect your privacy.

submit your comment